Michigan DOGE should consider re-allocating three outdated areas of Tobacco Funding.

Michigan Tobacco Funds come from the state cigarette tax (approximately $650 million) and Tobacco Settlements ($260.6 million). Michigan law divides revenue from the cigarette tax so that set percentages fund schools, Medicaid, capitol building projects, urban areas, and the general fund.

Settlement money has funded such unrelated projects as Michigan Merit Awards, budget shortfalls, and bailing out Detroit bankruptcy.

MDHHS Tobacco Funds

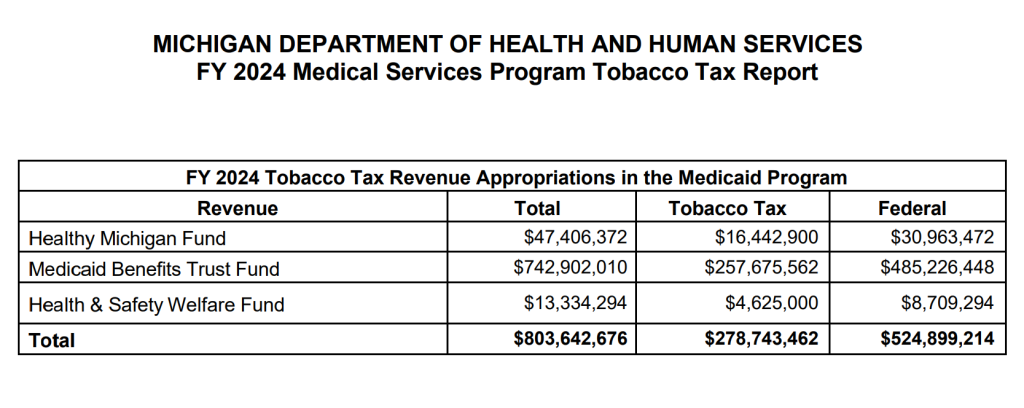

According to its annual spending report, MDHHS Tobacco Funds pay for Medicaid programs for asthma, smoking cessation, and vaccine advocacy and data collection.

Asthma and smoking cessation

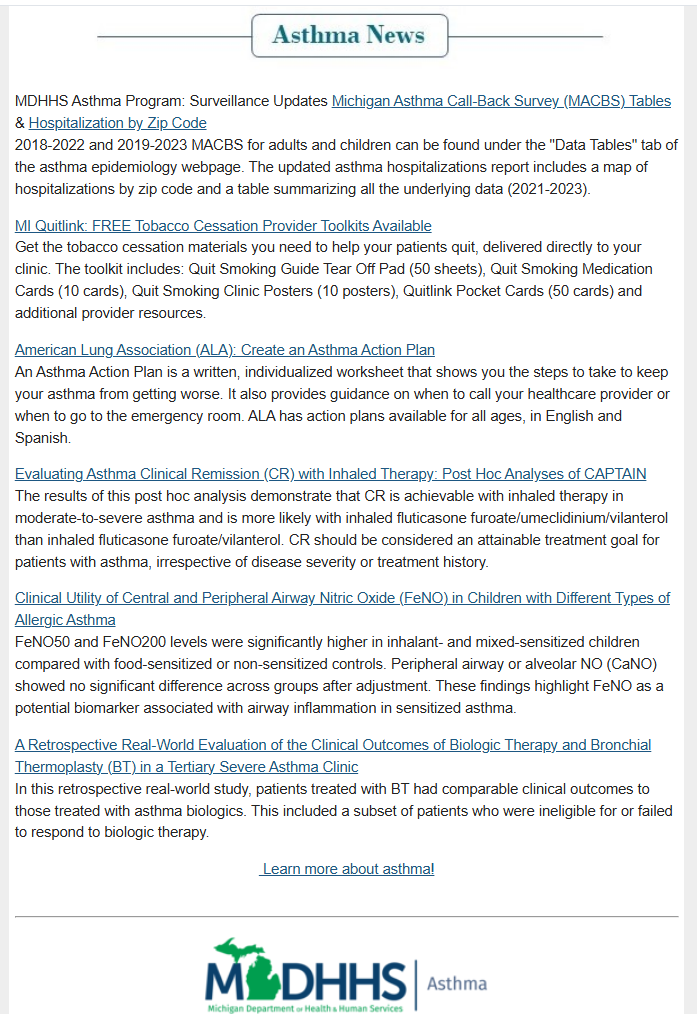

Twice every week, an MDHHS employee aggregates asthma information links from “partners” and formats them for distribution to the department email list. I estimate this work time at 2-3 hours/week.

For example:

These twice-weekly MDHHS asthma emails duplicate Google, and are probably not as current.

Note that the Asthma News also advertises MDHHS tobacco cessation.

Presumably, this falls under prevention, funded at $1,661,900 this year.

MDHHS 2023 infographic advocating for more tobacco prevention funds

However, this too duplicates information that is readily available online.

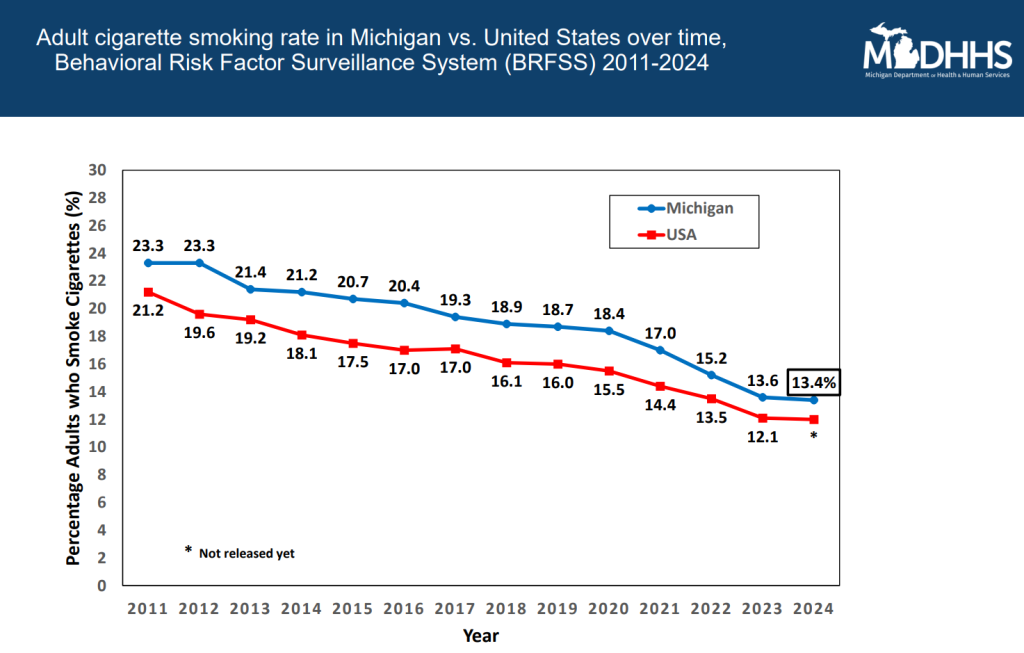

In addition, the number of Michigan smokers has dropped significantly since 2013.

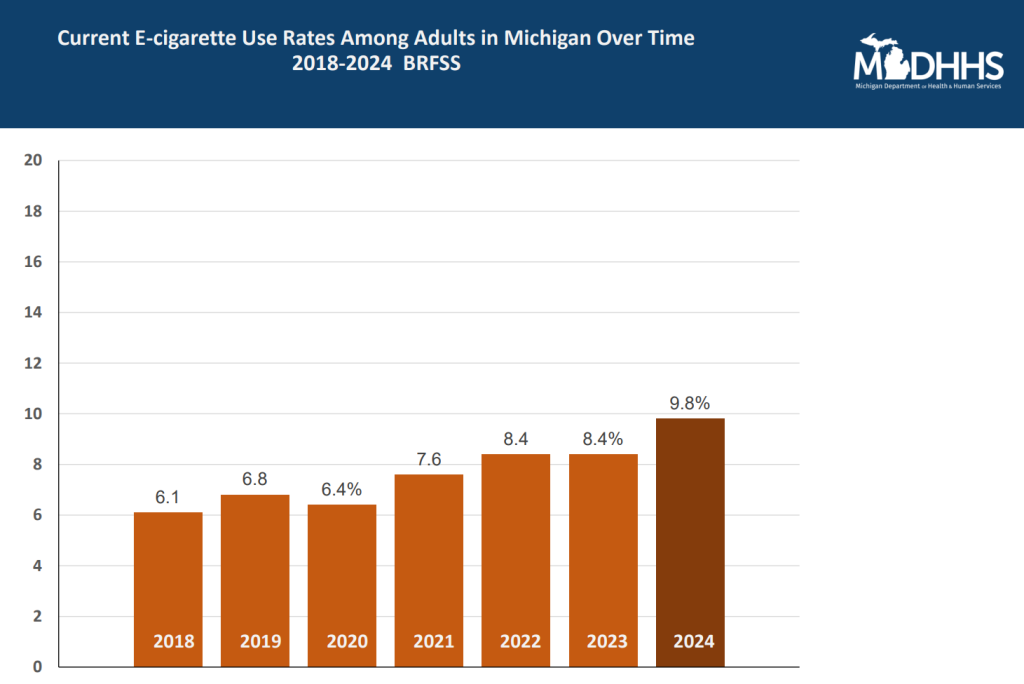

Meanwhile, e-cigarette use increased.

The state’s smoking cessation program might be considered effective, or a draw given the similar increase in alternative nicotine use.

Either way, Michigan lawmakers should not expand the tobacco tax. Instead, they can reconsider current funding.

Recommendation 1:

The Asthma News should be retired, and the man-hours deployed more effectively elsewhere.

The unique services MDHHS offers are the smoking cessation hotline and free clinical handouts. Legislators could evaluate usage rates, and re-allocate tobacco funds accordingly.

Immunization Funds

Michigan Care Improvement Registry (MICR) receives $1,188,300 in tobacco funds each year to advocate for vaccines and centralize immunization records.

Lawmakers might consider reducing these funds in light of falling Michigan pediatric vaccination rates and new federal guidelines.

The CMS Mandatory Reporting Guidance for Medicaid, Pg 4 removes pediatric and prenatal vaccine mandates for 2026.

The 2027 guidelines will require states to report consent provisions. This hiatus is worth starting a discussion about maintaining Tobacco Funds for MICR.

Long term care

According to the MMDHS annual report, long term care funding from the Tobacco Tax fell in the last budget cycle, even though the numbers of qualifying poor rose from 40,543 to 40,942.

Recommendation 2:

Healthcare costs continue to rise, and the disabled and elderly poor suffer the most.

Tobacco funds saved from outdated asthma, smoking cessation, and MICR programs should be redirected towards long term care.